Are the Markets Picking Up and When Is the Interest Rate Going Up Again?

Bond yields are ascension once again so far in 2022. The U.S. stock market seems vulnerable to a bona fide correction. Simply what can you really tell from a mere two weeks into a new year? Not much and quite a lot.

One thing feels assured: the days of making easy money are over in the pandemic era. Benchmark interest rates are headed college and bond yields, which have been anchored at historically low levels, are destined to rise in tandem.

Read: Weekend reads: How to invest amid college inflation and as interest rates rise

It seemed equally if Federal Reserve members couldn't make that point whatever clearer this by week, ahead of the traditional media blackout that precedes the central banking company's kickoff policy meeting of the year on Jan. 25-26.

The U.Due south. consumer-cost and producer-price index releases this week have simply cemented the market place'south expectations of a more than aggressive or hawkish monetary policy from the Fed.

The only real question is how many involvement-rate increases will the Federal Open up Market place Commission dole out in 2022. JPMorgan Chase & Co. JPM CEO Jamie Dimon intimated that seven might exist the number to beat, with market-based projections pointing to the potential for three increases to the federal-funds charge per unit in the coming months.

Check out: Here'southward how the Federal Reserve may shrink its $8.77 trillion balance sheet to gainsay high inflation

Meanwhile, yields for the 10-yr Treasury note yielded 1.771% Friday afternoon, which means that yields accept climbed past virtually 26 footing points in the offset 10 trading days to start a calendar year, which would be the briskest such rise since 1992, according to Dow Jones Market Data. Dorsum xxx years ago, the 10-year rose 32 basis points to effectually 7% to commencement that twelvemonth.

The 2-year note BX:TMUBMUSD02Y, which tends to exist more sensitive to the Fed's interest rate moves, is knocking on the door of ane%, upwards 24 basis points so far this twelvemonth, FactSet data testify.

But do involvement rate increases translate into a weaker stock market place?

Equally it turns out, during then-called rate-hike cycles, which we seem ready to enter into as early on as March, the market tends to perform strongly, not poorly.

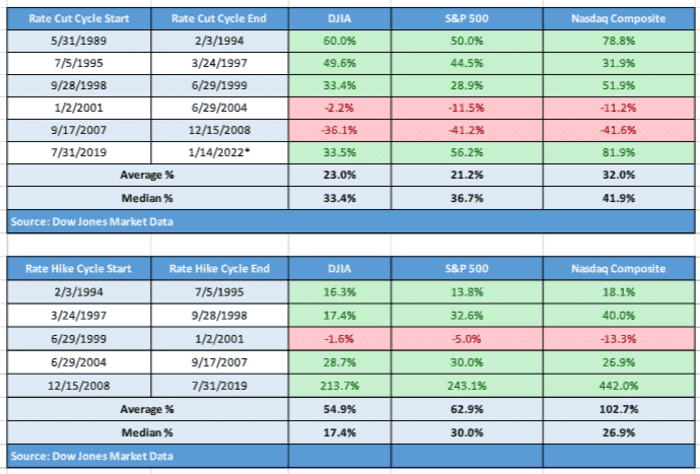

In fact, during a Fed rate-hike flow the average return for the Dow Jones Industrial Average DJIA is nearly 55%, that of the S&P 500 SPX is a gain of 62.ix% and the Nasdaq Composite COMP has averaged a positive return of 102.7%, according to Dow Jones, using data going dorsum to 1989 (run across attached table). Fed interest rate cuts, mayhap unsurprisingly, also yield potent gains, with the Dow up 23%, the Southward&P 500 gaining 21% and the Nasdaq rising 32%, on average during a period of Fed rate cuts.

Dow Jones Market Information

Involvement rate cuts tend to occur during periods when the economy is weak and charge per unit hikes when the economy is viewed as likewise hot past some measure, which may account for the disparity in stock market operation during periods when interest-charge per unit reductions occur.

To be sure, it is harder to run into the market producing outperformance during a catamenia in which the economic system experiences 1970s-style aggrandizement. Right at present, it feels unlikely that bullish investors will get a whiff of double-digit returns based on the style stocks are shaping up and so far in 2022. The Dow is down one.2%, the Southward&P 500 is off 2.2%, while the Nasdaq Composite is downward a whopping 4.8% thus far in January.

Read: Worried about a bubble? Why y'all should overweight U.S. equities this year, according to Goldman

What's working?

So far this year, winning stock marketplace trades have been in free energy, with the S&P 500's energy sector 20:SP500 XLE looking at a xvi.4% advance so far in 2022, while financials Twenty:SP500 XLF are running a distant 2nd, upwardly 4.4%. The other ix sectors of the S&P 500 are either flat or lower.

Meanwhile, value themes are making a more pronounced improvement, eking out a 0.1% weekly gain terminal week, as measured by the iShares Due south&P 500 Value ETF IVE, just calendar month to appointment the return is 1.ii%.

See: These 3 ETFs allow y'all play the hot semiconductor sector, where Nvidia, Micron, AMD and others are growing sales rapidly

What's not working?

Growth factors are getting hammered thus far as bond yields rise because a rapid rise in yields makes their future cash flows less valuable. Higher interest rates too hinder technology companies' ability to fund stock buy backs. The popular iShares Southward&P 500 Growth ETF IVW is down 0.6% on the week and downwards 5.one% in January so far.

What's really not working?

Biotech stocks are getting shellacked, with the iShares Biotechnology ETF IBB downwardly 1.one% on the week and 9% on the month so far.

And a popular retail-oriented ETF, the SPDR Southward&P Retail ETF XRT tumbled 4.i% concluding week, contributing to a vii.iv% decline in the calendar month to date.

And Cathie Woods's flagship ARK Innovation ETF ARKK finished the calendar week down nearly v% for a 15.two% decline in the outset two weeks of Jan. Other funds in the complex, including ARK Genomic Revolution ETF ARKG and ARK Fintech Innovation ETF ARKF are similarly woebegone.

And popular meme names likewise are getting hammered, with GameStop Corp. GME down 17% last calendar week and off over 21% in Jan, while AMC Entertainment Holdings AMC sank nearly xi% on the calendar week and more than 24% in the calendar month to appointment.

Grayness swan?

MarketWatch's Bill Watts writes that fears of a Russian invasion of Ukraine are on the ascension, and prompting analysts and traders to weigh the potential fiscal-market stupor waves. Here's what his reporting says about geopolitical risk factors and their longer-term affect on markets.

Week ahead

U.S. markets are closed in observance of the Martin Luther King Jr. holiday on Monday.

Read: Is the stock market open on Monday? Here are the trading hours on Martin Luther King Jr. Twenty-four hour period

Notable U.Southward. corporate earnings

(Dow components in bold)

TUESDAY:

Goldman Sachs Group GS, Truist Financial Corp. TFC, Signature Banking company SBNY, PNC Fiscal PNC, J.B. Chase Transport Services JBHT, Interactive Brokers Group Inc. IBKR

WEDNESDAY:

Morgan Stanley MS, Banking concern of America BAC, U.Due south. Bancorp. USB, State Street Corp. STT, UnitedHealth Grouping Inc. UNH, Procter & Risk PG, Kinder Morgan KMI, Fastenal Co. FAST

THURSDAY:

Netflix NFLX, United Airlines Holdings UAL, American Airlines AAL, Baker Hughes BKR, Discover Financial Services DFS, CSX Corp. CSX, Union Pacific Corp. UNP, The Travelers Cos. Inc. TRV, Intuitive Surgical Inc. ISRG, KeyCorp. KEY

Fri:

Schlumberger SLB, Huntington Bancshares Inc. HBAN

U.S. economic reports

Tuesday

- Empire State manufacturing alphabetize for Jan due at 8:thirty a.yard. ET

- NAHB dwelling builders index for January at 10 a.m.

Wednesday

- Building permits and starts for December at 8:30 a.m.

- Philly Fed Index for Jan at 8:thirty a.m.

Thursday

- Initial jobless claims for the week ended January. 15 (and continuing claims for Jan. eight) at 8:30 a.m.

- Existing habitation sales for December at ten a.yard.

Friday

Leading economic indicators for December at 10 a.m.

torresauntrunt1959.blogspot.com

Source: https://www.marketwatch.com/story/get-ready-for-the-climb-heres-what-history-says-about-stock-market-returns-during-fed-rate-hike-cycles-11642248640

0 Response to "Are the Markets Picking Up and When Is the Interest Rate Going Up Again?"

Post a Comment